Bank-based reusable identity provides a lower friction alternative to verification methods such as photo ID scans and out-of-wallet questions by delegating user authentication and identity to the end-user’s preferred bank. Bank-based ID is a tried and tested concept with a strong track record in countries like Sweden and Canada. Use cases include document signing, client portal registration and access, and employee onboarding.

Banks are ideal identity providers because they already have customer trust and high levels of engagement (often several times per week), along with extensive investments in Know-Your-Customer (KYC) required by regulators and Strong Customer Authentication (SCA).

IDPartner connects with existing bank-based ID solutions where they are already available and is working with banks to bring these solutions to market in countries where no ready-made network exists.

IDPartner and Auth0 Provide a Best-in-Class Experience for Developers and End-Users Alike

IDPartner provides a social login-like service that simplifies onboarding, sign-in, and account recovery processes for businesses that require a higher level of trust and security wherever they are. Our integration with Auth0 allows developers to integrate this capability almost seamlessly as part of their existing Auth0 deployment, helping increase conversions, engagement, and customer satisfaction.

IDPartner gives financial institutions, developers, and end-users control over what and how identity data can be accessed — always with explicit user consent and in real time. There is no need to scan a passport or take a selfie. Instead, the user’s trusted financial institution will authenticate and identify users with bank-grade assurance.

The user experience is straightforward. To verify identity for a site or app, the user clicks the ‘Choose your IDPartner’ button and selects their preferred financial institution or reusable identity credential. The user authenticates and consents to share personal information before being redirected back to the site.

IDPartner supports thousands of financial institutions in the US and UK, with additional countries about to come online. Additionally, anyone with a US driver's license or passport can verify their identity using Airside, the developer of a user-controlled digital identity app approved by TSA and used by the world’s largest airline.

End-user experience: This video demonstrates the end-user experience with IDPartner and Auth0. To directly experience IDPartner as an end-user, try our X (Formerly Twitter) NotABot and LinkedIn NotABot experiences. We created NotABot to give end-users, developers, and investors an idea of end-user experience when using IDPartner. The apps allow you to create a Tweet or a LinkedIn Post demonstrating you are a verified human.

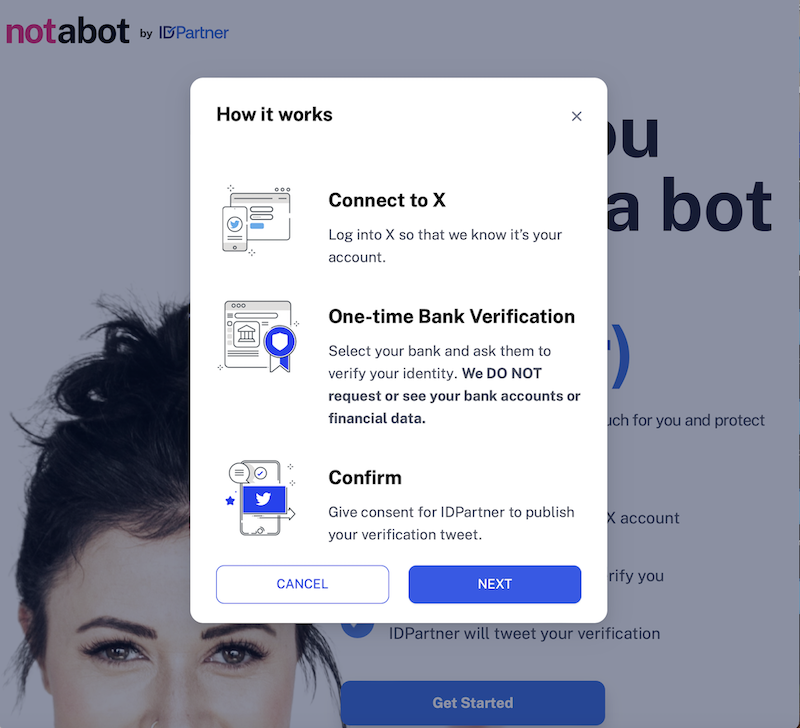

Here is an example of a Tweet verifying I am not a bot on X, starting with the beginning of the journey, which displays the required steps:

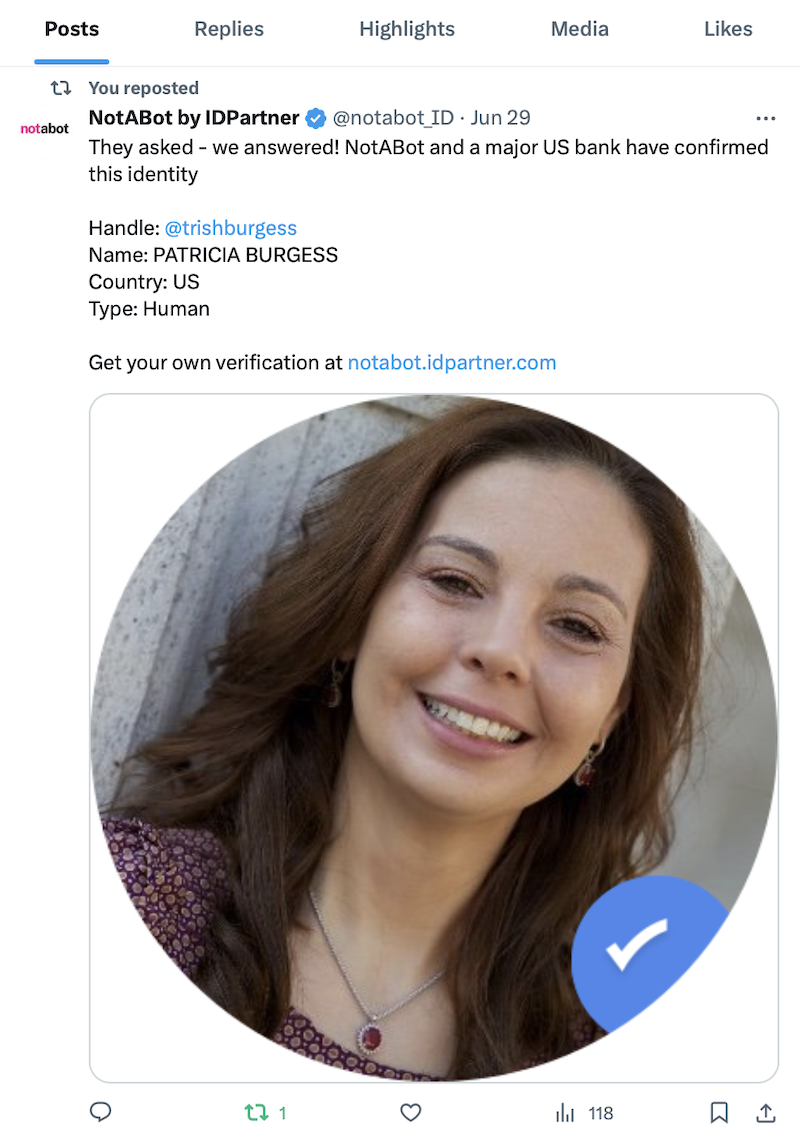

And here’s the end result — a retweet in my X feed of my type, Human, along with my verified avatar and my name:

Developer experience: IDPartner has worked closely with Auth0 to ensure developers have an easy integration process. The full set of instructions can be found here, with additional information being available directly from the IDPartner documentation site. Do not hesitate to reach out to support@idpartner.com if you have any questions as you learn more about IDPartner.

Some Key Use Cases Covered by IDPartner and Auth0

Here are some ways IDPartner and Auth0 can deliver better and more secure experiences for consumers:

- Trust and safety: Verify users on your platform so that your marketplace can thrive, free from bots and fraudsters.

- Secure customer portals: Drive digital engagement by simplifying sign-up and secure access for your billing and communications channels.

- Document signing: Know that the person reading and signing your contract is really who they claim to be.

- Background checks: Quickly verify the identity and qualifications of job applicants, tenants, or other individuals.

Generally speaking, IDPartner is a good fit for all use cases that require verified onboarding to avoid fake accounts, fraud and misinformation, strong user privacy and security, and bot detection.

Customer Story: Avvanz, a Background Check Company Breaking Ground in the US

Avvanz is a multi-award winning HR tech and Fintech firm that enables fast, simple, and secure employee screening and onboarding and has added reusable bank-based digital identity as an additional way to further secure their processes and protect employers and employees alike.

Avvanz serves around two thousand companies across the globe, providing an ‘Amazon-like’ experience for their customers with more than 20 types of background checks across 150+ countries. But there is always a possible gap in ensuring that an individual is who they say they are, including possible fake credentials, inflated employment history, or even criminal/financial offenses.

A robust digital identity verification system integrated with a well-tuned screening platform can further simplify and accelerate the process while ensuring compliance with data privacy and other regulatory requirements. This is where the IDPartner-Avvanz partnership becomes indispensable as it adds this essential digital identity verification to the background screening process.

Here is a conversation between the two companies’ CEOs. It will give you an idea of the benefits that IDPartner brings to Avvanz’s end-user experience. We would love to have a similar conversation with you, as our first customer spoke about their experience offering IDPartner via the integration with Auth0.

Be Part of the Future of Identity, Join the Movement

The product is commercially available with integrations covering over 8,000 US and UK financial institutions. Still, it is just the first step in our journey to provide consumers with instant one-click access to any digital service requiring ID verification without affecting the ease of integration for developers.

As this model comes into place, the experience will be similar to the one in this video.

How Do I Get Started with Auth0 and IDPartner?

All types of businesses can leverage IDPartner’s integration with Auth0 to enable bank-grade consumer authentication and identity verification.

Register now with this link to gain access to IDPartner’s experts, who are ready to discuss your needs and support a successful implementation. Our team will help you integrate our solution seamlessly.

About the author

Trish Burgess

Co-founder and COO - IDPartner Systems Inc.

Trish Burgess is co-founder and COO at IDPartner, a mission-driven startup built to establish global digital trust, fight fraud, and combat misinformation. She has spent the last 10 years building and launching global digital products in the FinTech, payments and identity spaces, including with household names such as Apple (Apple Pay and Apple Card) and Visa. Her accomplishments are driven by her boundless curiosity and her courage of conviction, which help her bring innovative perspectives and drive ideas into action. She holds an M.B.A from The Wharton School, University of Pennsylvania, and M.Sc.Eng. in Computer Networks by Universidad Politécnica de Madrid, Spain. She lives in the San Francisco Bay Area with her daughter and husband.

View profile