AI is reshaping the financial services landscape. From smarter fraud detection to personalized advice and faster underwriting, it’s helping banks, credit unions, fintechs, and insurers operate more efficiently and stay competitive. But as AI becomes more capable and more autonomous, it raises a critical question:

Who, or what, is accessing your systems, data, and decision engines?

In an industry built on trust, that question needs a confident answer. Every AI-powered transaction, recommendation, and decision must be authenticated, authorized, and auditable. This is where a new generation of identity solutions, like Auth0 for AI Agents, becomes indispensable.

How GenAI is Expanding Identity Landscape in Financial Services

Historically, identity management in financial services focused on people. Employees logged into internal systems. Customers signed in to access their accounts. But that approach no longer fits the world AI is creating.

Today, AI agents operate autonomously. They trigger decisions, initiate actions, and access sensitive data without needing human involvement. As a result, the traditional identity perimeter no longer exists. This shift adds urgency. Financial institutions are expanding their use of AI across critical workflows, yet only 26% say they are very confident in their current identity management strategy (Auth0, 2025).

Discover more stats & insights in the Auth0 Customer Identity Trends Report 2025.

That gap highlights a growing risk.

To stay ahead, financial organizations need to rethink what identity means. It’s no longer just about who the user is. It’s also about what’s acting on the user’s behalf and under what authority. Institutions now need to manage:

AI systems performing actions and making decisions on a user’s behalf

Asynchronous workflows where AI agents work in the background until a condition is met

APIs and services that carry out sensitive operations on behalf of users

The traditional identity perimeter has disappeared and the stakes have never been higher.

Why AI Amplifies the Stakes for Identity Security

AI creates tremendous value for financial institutions. It can process data at scale, spot anomalies in real time, and power personalized experiences at a level humans simply cannot match. But those same strengths introduce new risks if not properly governed. Systems that act with speed and autonomy must be held to the same standards of accountability as their human counterparts.

As adoption grows, so do the threats. More than 50% of fraud now involves the use of AI, including hyper-realistic impersonations such as deepfakes and synthetic identities. These attacks are harder to detect, harder to verify, and far more scalable (Feedzai, 2025). This is why identity must become a control point for AI. Any system that acts on behalf of a user or makes decisions involving customer data must be authenticated, authorized, and auditable.

Identity as the Control Plane for AI

CIAM is more than just login and password management. It’s the control layer that governs how people and systems access data and capabilities. In the context of AI, this means:

- Authentication for all entities: Verify human users as well as AI agents, APIs, and services, using standards like OpenID Connect and token-based protocols.

- Fine-grained authorization: Access to data and systems is enforced at the most granular level, so AI systems can only retrieve or act on data they are explicitly allowed to see or use.

- Consent and privacy enforcement: Manage consent dynamically and help ensure data used in AI workflows supports alignment with regulations like GDPR, CCPA, and GLBA.

- Auditability and accountability: Log every event, whether human or machine, for compliance, internal review, or customer assurance.

- Adaptive security: Support dynamic risk detection and adaptive MFA to help secure high-risk or unusual interactions without degrading user experience.

Where AI Is Creating Real Value Today

Financial institutions are already seeing the benefits of AI in real use cases, including:

| Use Case | Description |

|---|---|

| Fraud detection systems | AI models analyze transactional and behavioral data in real time to identify anomalies and prevent fraud before it impacts customers or the institution. |

| Conversational AI and Virtual Assistants | Chatbots and voice-enabled assistants handle customer service tasks such as account inquiries, password resets, and claims status updates, improving availability and response times. |

| Hyper-Personalized Financial Advice | AI tools generate individualized recommendations for budgeting, investing, and saving by analyzing customer data and behavior across channels. |

| Credit Risk Assessment and Underwriting | AI enhances credit scoring and underwriting decisions by incorporating alternative data and streamlining evaluations for loans, credit cards, and insurance products. |

Automated Document Processing and Reporting | Natural language processing and computer vision automate the review of contracts, regulatory filings, and customer-submitted documents to improve speed and accuracy. |

Predictive Market Analysis and Algorithmic Trading | AI models analyze market trends and execute trades or generate investment insights, helping institutions respond faster to volatility and opportunity. |

The Strategic Opportunity for Financial Leaders

AI adoption is accelerating across financial services. According to recent research, 86% of financial services organizations using AI say it will be very or critically important to their business success over the next two years (Deloitte, 2025). That level of strategic importance makes it essential to get the foundations right. Identity is not just about reducing risk. It’s a critical enabler that supports secure, scalable AI across every user and system interaction.

With the right identity infrastructure in place, financial institutions can:

Deliver trusted experiences: Customers expect AI to be secure, transparent, and personalized. CIAM helps you meet those expectations.

Innovate confidently: Guardrails help ensure that AI initiatives can scale without compromising security or compliance.

Stay ahead of regulation: Strong identity governance enables clear audit trails and proactive risk management as AI-related regulations evolve.

Manage complexity at scale: Control access across humans, machines, APIs, and hybrid workflows from a single platform.

Trust Starts with Identity… and Extends to Every Agent

Trust is at the heart of every financial transaction. As AI systems begin to act on behalf of users, it’s essential to apply identity controls to those systems too. Without identity verification and clear access controls, AI can create blind spots and expose sensitive data.

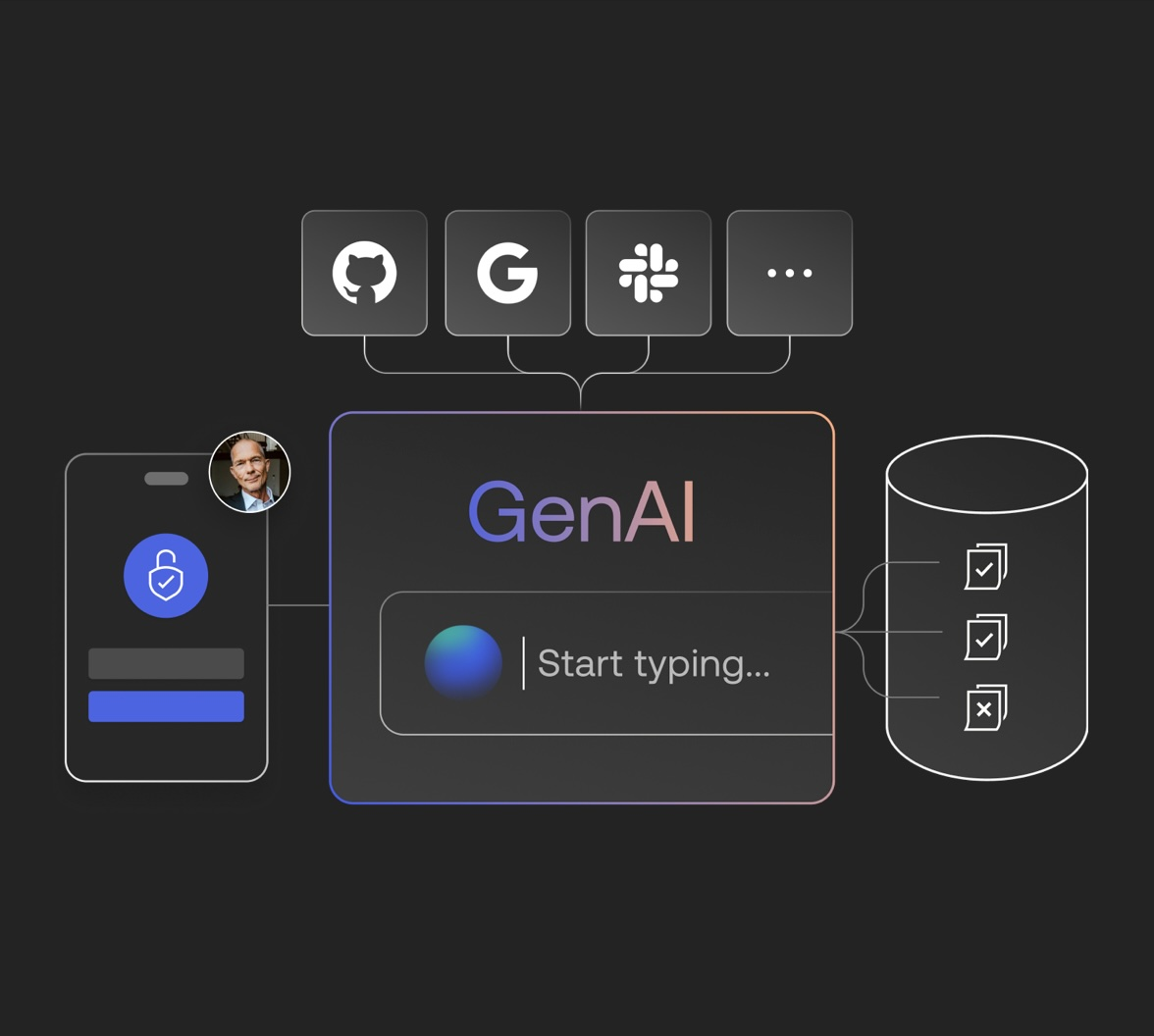

Auth0 for AI Agents is designed to close these gaps. It brings identity and access security to AI-powered workflows across financial services.

With Auth0 for AI Agents, you can:

- Authenticate users and connect their identity to AI agent activity

- Help securely store and manage API tokens without hardcoding secrets

- Require user approval for sensitive agent-initiated actions

- Enforce fine-grained access controls for document retrieval in RAG workflows

Whether you're a bank, credit union, fintech, or insurer, Auth0 for AI Agents gives you the tools to innovate responsibly.

AI agents don't have to be a risk. With the right identity foundation, they can be more secure, auditable, and trusted.

Ready to learn more? Visit the Auth0 for AI Agents page or contact us for a demo.

About the author

Christopher Ottman

Staff Product Marketing Manager

Christopher Ottman is a Staff Product Marketing Manager, Financial Services at Okta. He leads go-to-market strategy, messaging, and growth initiatives that help financial institutions modernize their identity infrastructure, improve customer experiences, and meet evolving security and compliance demands. Before joining Okta, he held B2B product marketing roles across fintech, SaaS, and telecom—supporting both growth-stage startups and enterprise organizations.

Based in Toronto, Christopher is passionate about connecting technology to real-world outcomes and solving meaningful customer problems. Outside of work, he loves to travel and explore new cultures around the globe.