Yesterday, Brian Krebs from Krebs on Security reported that his PayPal account had been hacked using one of the oldest hacking methods: social engineering, and knowing some pieces of static information about the account owner —the last four digits of an old credit card and the last four digits of the social security number—.

Being a known security expert, Brian had a strong account password; that is, it was long and complex, and used all types of characters. A strong password is mandatory, especially for a service that is directly linked to the user's credit cards. In Brian's case, he soon discovered that it was not his password that was compromised. Instead, the cyber criminal called PayPal customer support, impersonated him, and got access to his account in a matter of minutes, having provided only that static and easy-to-obtain information about the user, not once but twice.

5 Things that Could Have Prevented the Hack

In this post, we'll teach you five things you can implement to prevent your users from being hacked. Make Brian safe again!

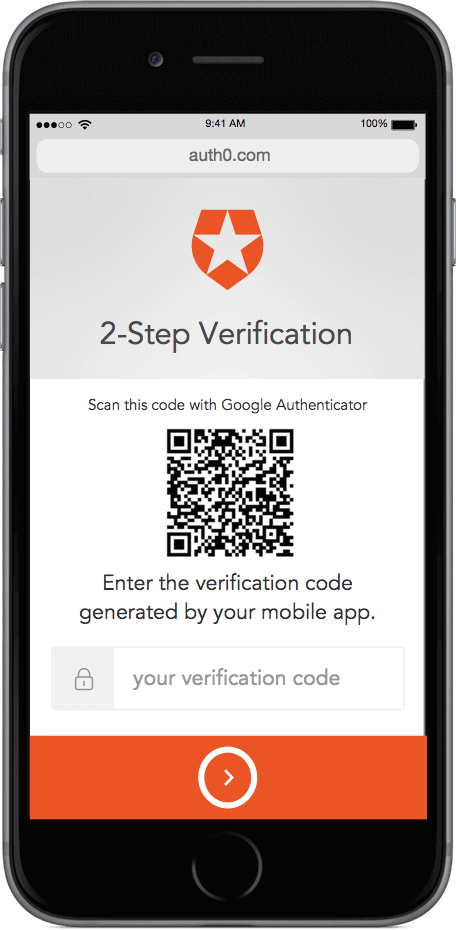

1 - Multifactor Authentication

Multifactor Authentication (MFA) is a method of identifying users by presenting several separate authentication stages. Some of those stages could be a Time-based One-Time Password (TOTP), mobile verification, or a hardware token, among others.

Learn more about MFA, in the Get Started with MFA landing page.

Believe it or not, most of the biggest retail stores don't provide these additional layers of security or are just starting to provide them. For example, Amazon added this option in mid-November without making an official announcement, as reported by The Verge.

With MFA, a cyber criminal must not only know the password, but also possess a mobile phone or token device in order to access the account. Some companies believe that enforcing multifactor authentication could result in the loss of a significant number of users; for those companies, an intermediate solution can be achieved by requiring a second factor only for resetting the password.

PayPal has this option available by using hardware tokens, but evidently this is not required in their password reset flow.

2 - Passwordless Login via sms and email

With Passwordless Login you can use one-time codes or “magic links” delivered via SMS or email. In this way, only users who have access to the registered email account or registered phone will be able to login. If PayPal support had offered this option, they could have ensured that the person claiming access was the legitimate owner by sending an email or SMS with a code or link. > You can read more about Passwordless here.

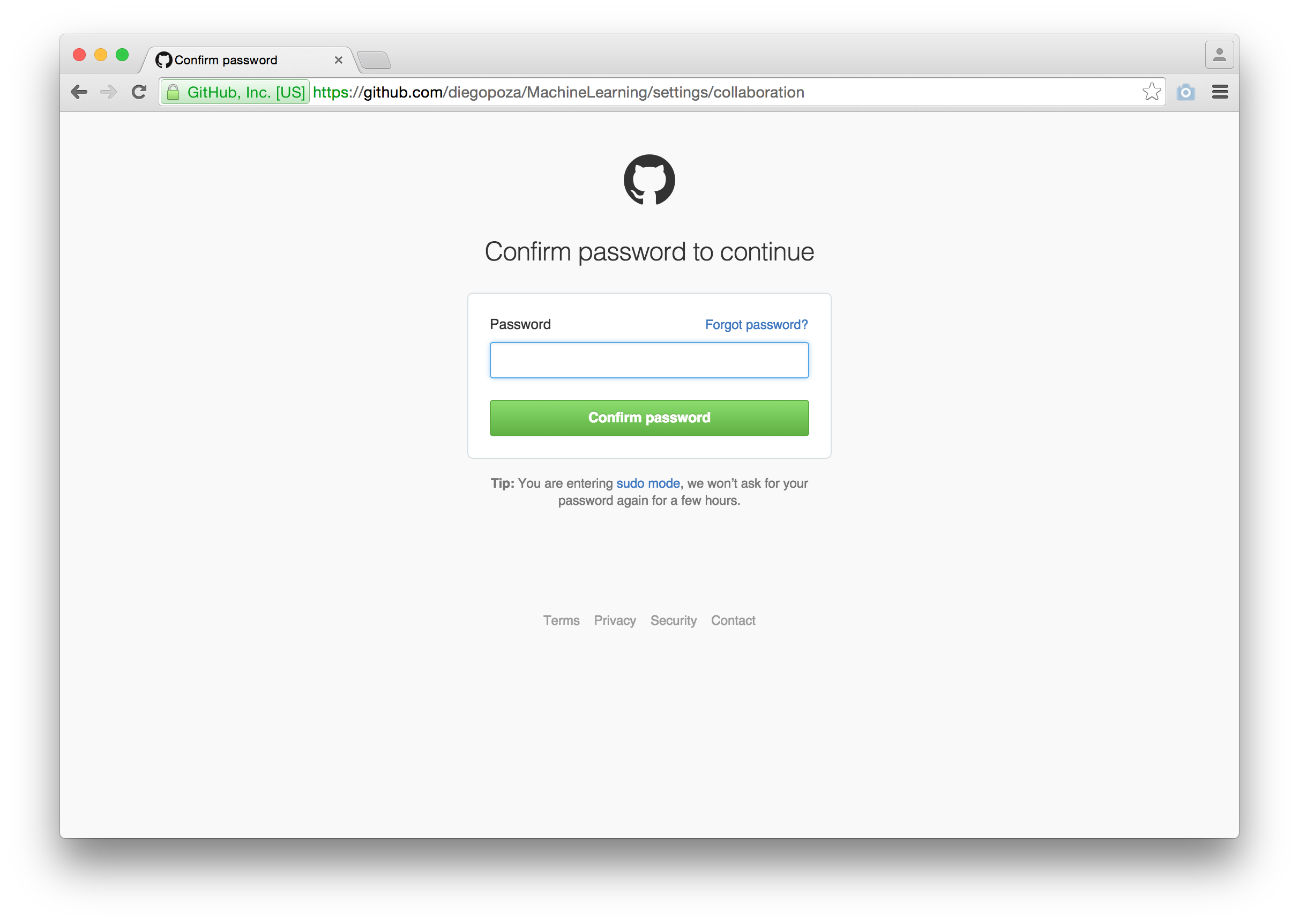

3 - Step Up Security

With Step Up Security, critical actions in user accounts—adding or changing email accounts, changing passwords, and so on—require additional security measures. Brian Krebs' attacker called customer support to reset his password. This critical action needed stronger security measures—such as multifactor or passwordless authentication—as the company should have ensured that it was being performed by the legitimate user.

4 - Trained Support

Companies must invest in training their customer support employees in security procedures. This point is often inadequately considered, which leads to situations like granting access to anyone with the sufficient static information. And this in turn will make the company lose its reputation.

“Companies must invest in training their customer support employees in security procedures.”

Tweet This

However, we have learned from past attacks that social engineering virtually always will succeed eventually. While training of support staff is needed, it must be part of a larger security strategy. Using a method above to build a system that requires customer verification is an important step in preventing social engineering.

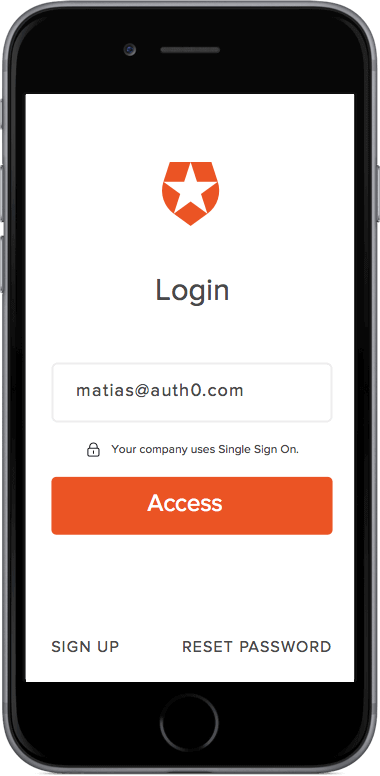

5 - Single Sign On with Another Service

Using Single Sign-On, once you log into one trusted service or provider, you don't have to enter your credentials again when entering another application that supports it, as you will be automatically logged into all supported applications, regardless of the platform, technology, or domain.

If PayPal had allowed Single Sign-On with another trusted service, it would have added an additional security layer to prevent the hack. A legitimate user who lost his password but could log into a trusted service could easily reset his password without needing to go through customer support.

Learn more about Single Sign-On.

Aside: How Auth0 Can Help You Strengthen the Security of Your Application's Accounts

Using Auth0 you can add the following features to your application in a breeze.

Multifactor Authentication: Using Auth0 you can have MFA implemented in minutes! You can use the out-of-the-box providers or easily integrate any different provider using Auth0's extensibility.

Passwordless: Auth0 Passwordless supports one-time codes or “magic links” delivered via SMS or email without having to worry about the implementation details.

Single Sign-On: By taking advantage of our wide range of SDKs you will have Single Sign-On with any Identity Provider running in minutes. Provide your users with a seamless authentication experience when they navigate either through the applications you built and/or third party apps.

Final Words

What it is interesting is that PayPal, populated by a lot of smart people and with more actual experience in online payment systems than almost anyone, relies on inherently insecure procedures. They certainly know everything Krebs talks about in his post, they have the resources to do something different, and yet they don’t. Why Paypal doesn’t have tighter procedures? The answer to that question is probably because their cost of fraud is lower than the cost of implementation. You can be 100% sure they’ve modeled it out and believe that tighter security drives away customers or some other cost factor that outweighs the cost of fraud. As we always say, if companies don't handle security properly, that could lead to losing their most precious asset: its reputation.

About the author

Diego Poza

Sr Manager, Developer Advocacy (Auth0 Alumni)