- Securing sensitive operations executed from your own services, such as approving bank transfers, access to operations history, and changes in access credentials.

- Securing sensitive operations requested from third-party services, such as approving digital payments and allowing one-time access for account verification.

You must configure transactional authorization for each API. Once activated, it applies to the scopes and

authorization_details.types for that API.Prerequisites

Before getting started, follow the instructions in Configure Rich Authorization Requests to register theauthorization_details.types for your API or .

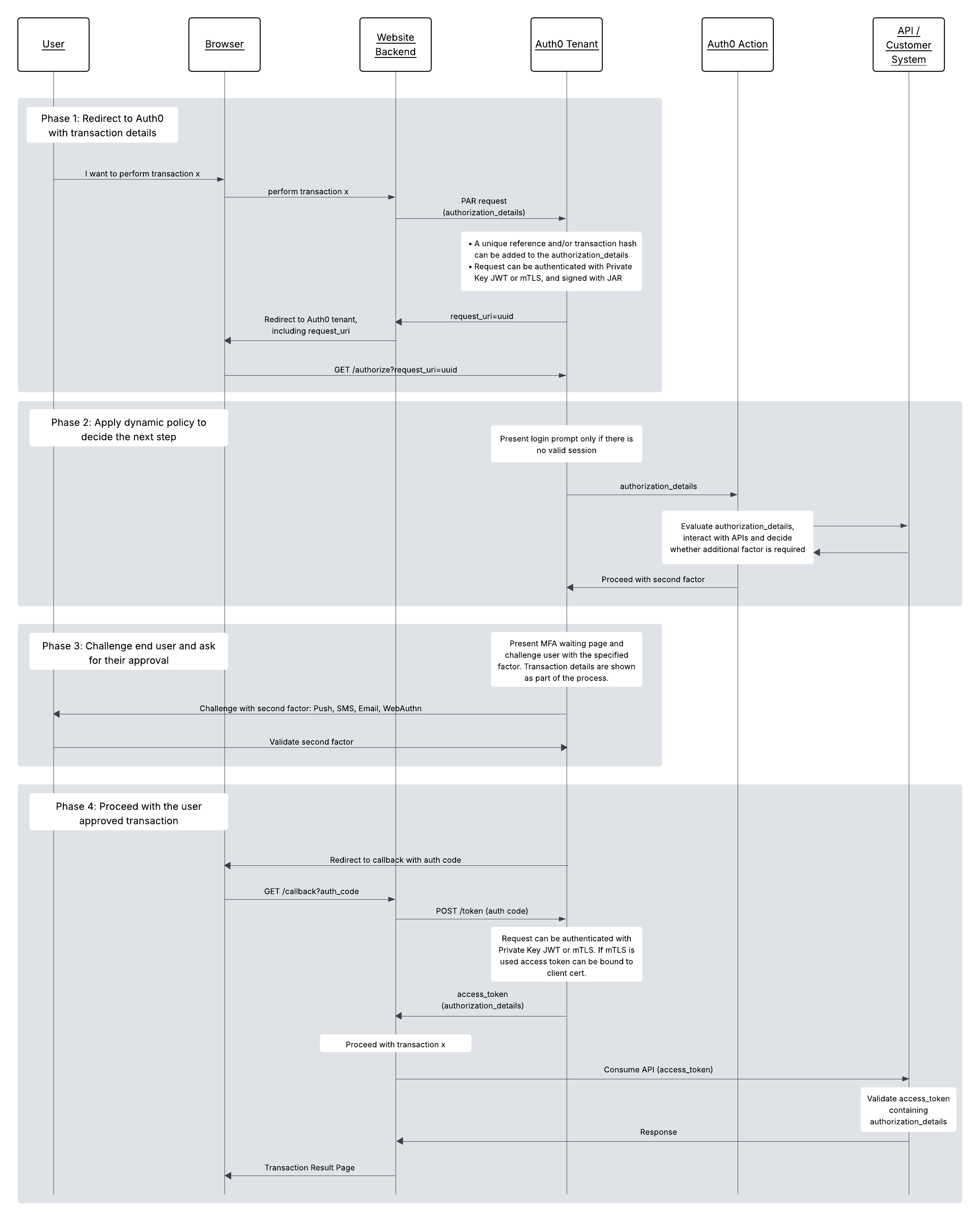

End-to-end flow

The following diagram shows the end-to-end flow for Transactional Authorization with Contextual SCA. There are four main phases:- Securely redirect the user to Auth0 with the transaction details. In this step, avoid revealing sensitive information on the front channel (e.g. the browser).

- Apply dynamic policy after the user authenticates. Using Actions, you can dynamically decide on the next steps based on the transaction details and other information you may get from sources such as external APIs. To learn more, read Apply dynamic policy.

- Challenge the user with a second authentication factor and show transaction details for the user to explicitly approve. This step depends on the authentication factor you chose to apply using Actions.

- Get the access token and proceed with the sensitive operation. Your API validates the approved transaction details associated with the access token.

Communicate transaction details and redirect to Auth0

The user first accesses your web application after authenticating with Auth0. Following our example use case, the user then requests a money transfer to one of their contacts. To meet financial-grade security standards, Highly Regulated Identity uses Pushed Authorization Requests (PAR) to hide transaction details from the browser. Instead of sending query parameters through the browser to the/authorize endpoint, PAR directly sends parameters from your backend to a special /par endpoint using a POST request. To learn how to set it up, read Configure Pushed Authorization Requests.

In the PAR request body, transaction details are sent as part of the authorization_details JSON object:

authorization_details to determine which authentication factors to use based on the transaction. To learn more about authorization_details and how to use it along PAR, read Authorization Code Flow with Rich Authorization Requests.

If you want to meet FAPI 1 Advanced Security compliance requirements, you must also use public key cryptography to authenticate the backend against the /par or the /token endpoint. This is more secure than sending a . Auth0 offers the following public key cryptography authentication methods:

After receiving a successful response to your PAR request, redirect the user to your Auth0 tenant’s /authorize endpoint. Add the request_uri parameter received in the PAR response and the client_id as the only query parameters, thus effectively hiding any sensitive information from the browser.

Apply dynamic policy

When the user logs in without using and the browser hits your Auth0 tenant’s/authorize endpoint, Auth0 will attempt to authenticate the user. In our example of approving a bank transfer, Auth0 has already authenticated the user to access your web application. However, when a third party redirects the user, such as for a digital payment, Auth0 presents a login screen to the user. To learn more about the authentication flow, read the Authenticate documentation.

Once Auth0 has successfully authenticated the user, Auth0 triggers post-login Actions, which expose transaction details about the user, app, authentication factor(s) used, and more in the post-login event object. Within the post-login event object, the event.transaction.requested_authorization_details property contains details about the authorization request that were received in the previous step.

Use the post-login event object to decide how you want to proceed with the transaction. For example, you can send transaction details to an external risk engine, and after evaluating the risk level, determine whether to request step-up authentication using sms, as illustrated in the following code sample.

Challenge the user to get transaction details approval

You can customize what authentication factor to use depending on factors enrolled by the user, factors already satisfied by the session, and/or your own preferences. You can also provide alternatives for the user to choose from. To learn more, read Customize MFA Selection in New Universal Login. Additionally, for SMS, email, and WebAuthn, you can customize the consent screen that Auth0 presents to the user with the information you want to show from authorization_details and other transaction details. To learn more, read Configure Rich Authorization Requests. For push notifications, this does not apply as the mobile application is the one showing the transaction details to the end user. The following sections explain the different authentication factors that you can configure for transactional authorization.Push notifications

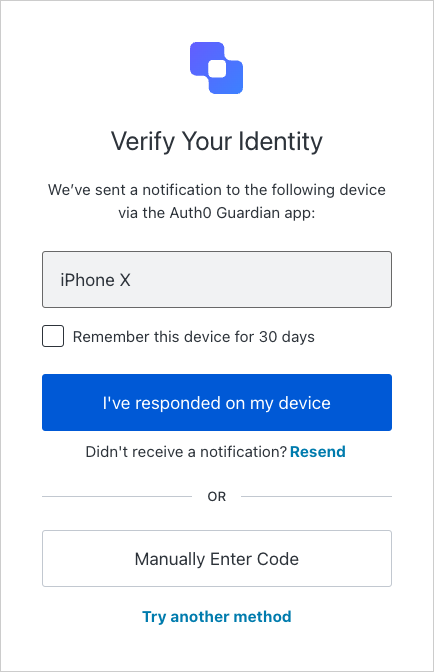

Send a push notification to a user’s enrolled mobile device while Auth0 prompts the user with the Multi-Factor Authentication (MFA) waiting screen on the consumption device (e.g. the laptop where the transaction originated).

otpFallback: false.

To display the authorization_details to the user, the mobile application must retrieve them from the txlnkid parameter. The Auth0 Guardian SDK passes the txlnkid parameter from the tenant to the mobile application via a push notification.

After the mobile application receives the push notification via the Guardian SDK, it can fetch the consent details, which includes the authorization_details, from the Auth0 Consent API:

- iOS

- Android

api.multifactor.enable() before api.authentication.challengeWith() to remove the option to remember this device and force the user to validate the push challenge for all transactions. To learn more, read Action Triggers: post-login - API object.

Once the user approves or declines the operation, the mobile application can allow or reject the MFA challenge. The transaction progresses to the Complete the operation phase.

To verify the identity of the user opening the push notification, you can add biometric authentication to the mobile application. To learn more, read Configure WebAuthn with Device Biometrics for MFA.

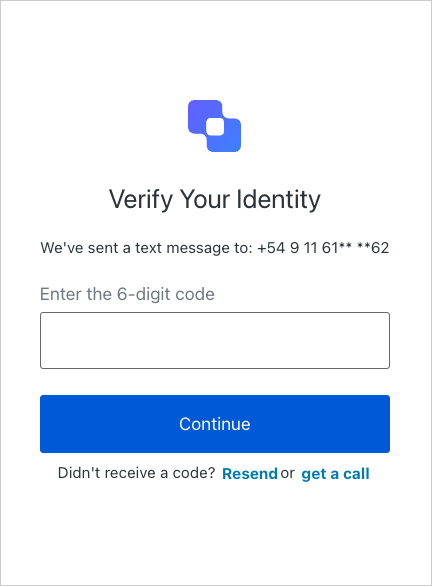

SMS, Email, or WebAuthn

You can also set up phone, email, or WebAuthn as authentication factors to challenge the user. For these authentication factors, Auth0 prompts the user with the corresponding MFA waiting screen. After the user validates the challenge on the MFA waiting screen, Auth0 shows the transaction details to the user for explicit approval. Remember you have to Configure Rich Authorization Requests for the approval step to work properly. For the phone authentication factor, Auth0 sends a verification code to the user through SMS or voice. The following screenshot shows the MFA waiting screen after Auth0 sent the code through SMS:

From Actions, you can call

api.multifactor.enable('any', { allowRememberBrowser: false }) before api.authentication.challengeWith to remove the option to remember this device and force the user to validate the push challenge for all transactions.No Challenge

If you don’t challenge the user with a second authentication factor, Auth0 prompts the user with the consent screen to get explicit approval for the transaction details.Complete the operation

To complete the operation, Auth0 follows the standard Authorization Code Flow. If the transaction is approved, the user browser is redirected to your application with an authorization code, which is then exchanged for an encrypted using JSON Web Encryption. The access token contains theauthorization_details that you originally passed. The following code sample shows the contents of a decrypted access token:

authorization_details to verify the transaction details, such as the amount, sender, destination, and more. Once verified, the money transfer successfully executes, and you should see the approval screen.

If the transaction is rejected at any step, the user browser displays an access_denied error code.