For executives, positioning your business for mergers and acquisitions is a bit like searching for a spouse: Ideally, two organizations join together in a binding relationship to create something that is greater than the sum of its parts. But just as most first dates don’t lead to marriage, most Merger and Acquisition (M&A) deals fall apart before they ever take place.

Often, due diligence reveals that one company’s internal operations are in disarray, and the dealmakers get cold feet. Even if the deal does go through, research shows that the majority of completed M&As end up coming at a loss to shareholder value.

If you’re looking to put together a successful M&A deal, you need to prove from the outset that you can integrate your operations with a new partner quickly, easily, and securely. That requires putting identity and access management (IAM) at the center of your M&A strategy.

IAM Integration Shouldn’t Slow Down Your M&A

When the ink is dry on your M&A deal, you want to hit the ground running and capitalize on synergies, locate economies of scale, and break into new markets. But part of a merger is the merging of data, allowing you to benefit from each other’s workforces, infrastructure, and market share. If your IAM solutions don’t integrate, you can wind up with duplicate processes, wasted resources, and team members who can’t access the information they need under the new structure.

Trying to handle post-merger integration is a challenge for most in-house developers because coding for identity is a specialized and constantly evolving field. If your IAM solutions aren’t compatible, it can easily take months to integrate applications, and that’s time that internal teams should spend on value creation.

A successful M&A deal has hundreds of moving parts — from consolidating your supply chains to picking out a new logo — and, inevitably, getting both parties in line takes time. But during the onboarding period, employees still need to be able to go ahead with business.

“Change is a huge part of post-merger integration. Find out how @auth0’s IAM solution is central to your M&A strategy.”

Tweet This

Kurt Borg, senior product owner of Auth0 customer Catena Media, has discussed the challenge of managing multiple teams during acquisitions: “We had a lot of systems that people used to log into with different accounts,” Borg says. “That is a nightmare to maintain and it’s a nightmare for scalability because new people join and need access... And when people leave that is the most delicate thing because you need to make sure that all access is closed. If you don’t have one centralized authentication system, there’s going to be a problem.”

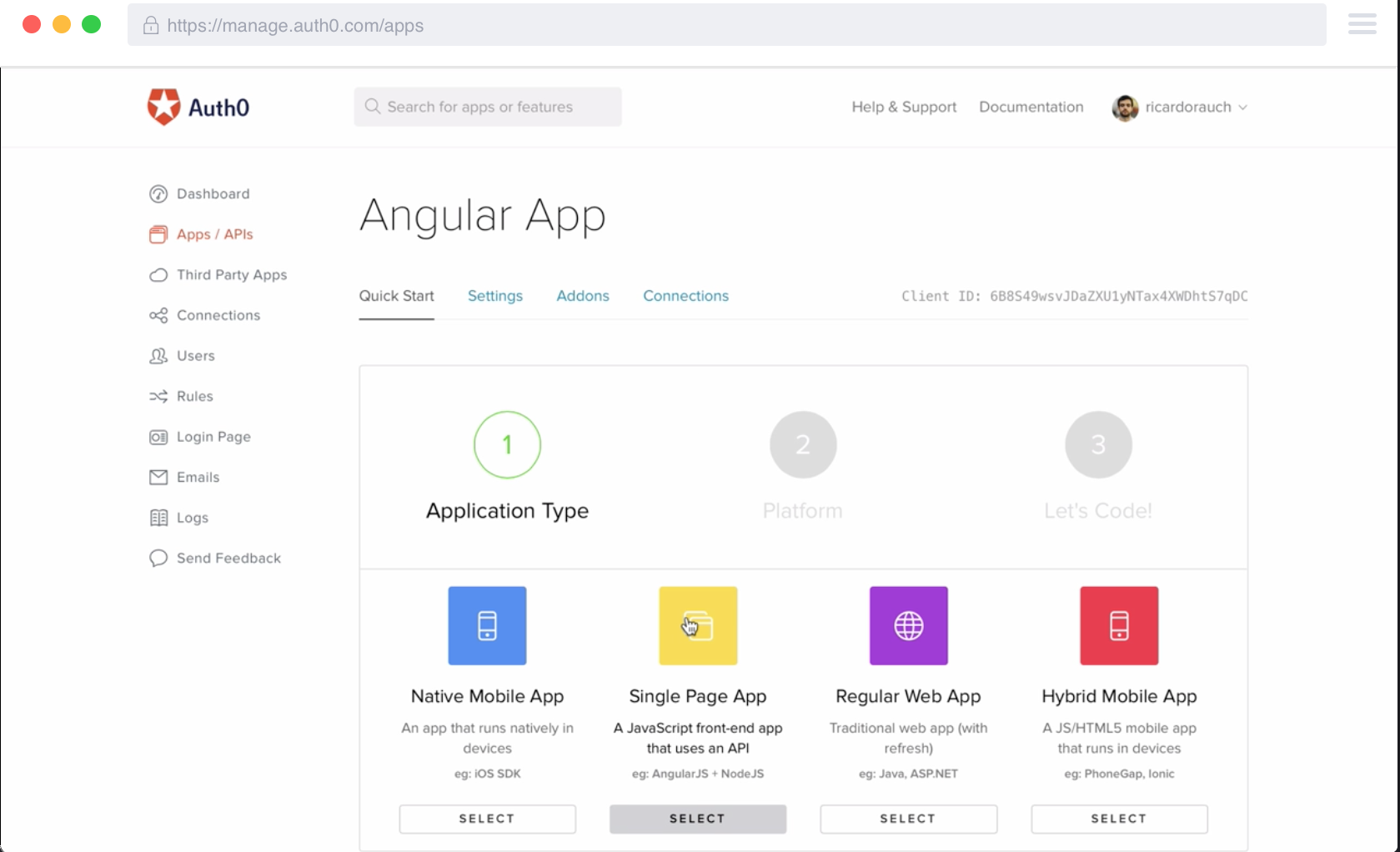

Controlling permissions across multiple systems requires an extensible IAM solution so administrators can manage disparate applications from a single location. Auth0’s platform connects to any application running on any platform or device, with detailed, step-by-step instructions so your developers can integrate across organizations as quickly as possible. That way, legacy applications aren't holding you back from locating cost synergies and embracing new technologies.

Mergers & Acquisitions Don’t Have to Compromise Customer Experience

Whether your business model is B2B or CIAM, the last thing you want to do is frustrate your customers with M&A disruptions, since every time you lose a customer, your M&A deal loses value. That’s why it’s vital to provide a seamless customer experience during the transition, even while you’re consolidating operations behind the scenes.

A modern IAM platform can enhance customer experience by providing frictionless access across multiple brands. Implementing Single Sign On (SSO) Authentication allows users to log in to one application and then gain access to all of a parent company’s business units without needing to sign in again. Not only does this benefit customer experience, but it’s also the first step in creating a single, unified view of your customer, rather than the same person logging in with multiple sets of credentials. Consolidating customer directories during M&As can take significant time, but with a federated approach to identity, you don’t have to wait to start creating a centralized repository of customer information to act as a single source of truth.

“Discover how #identitymanagement can help reduce the scalability nightmares during acquisition-driven expansions by streamlining post-merger integration.”

Tweet This

Ensuring customer satisfaction during an M&A isn’t just about improving their login experience, and your most important customer-facing touchpoints are your employees. Those employees can’t assist customers if the data they need is siloed, or if they’re struggling to navigate unfamiliar tech. But with a modern, centralized IAM platform, employees from across both organizations can access a complete profile of a customer and their needs while they're speaking, enabling them to offer the right assistance and products. Being able to offer IAM as a competitive advantage can increase the purchase price of an acquired company.

Data Security Can Be an M&A Liability… or an Asset

If data security was once an afterthought in M&A transactions, it’s now a make-or-break factor. Today, companies must contend with a new wave of global data privacy laws like GDPR and CCPA, which can impose debilitating fines for noncompliance.

Case in point: Marriott International was hit with a $123 million GDPR fine for a data breach that came as the direct result of IT problems with their acquisition of Starwood. Starwood’s network was compromised in 2014, Marriott acquired them in 2016, and in 2018, when the breach came to light, Starwood’s reservation system still hadn’t been migrated to Marriott’s system. The breach, and its fallout, has become a cautionary tale about the importance of data security due diligence in M&A deals.

Achieving compliance in a rapidly evolving regulatory landscape requires expertise and constant, ongoing maintenance, so a legacy, in-house IAM solution may have security or compliance gaps. Some SMBs may be too small to fall under CCPA or GDPR’s scope, but it should still be part of your growth strategy. Even if you’re confident your system is airtight, an M&A deal could fall through if your prospective acquirer is nervous that they’ll be inheriting unresolved issues.

To give potential M&A partners peace of mind that there are no skeletons in your data security closet, you first have to form a complete picture of where your data is being stored and who has access to it. Unfortunately, most businesses have sensitive information siloed across business units, shared via unsecured applications, or access to vendors or ex-employees. But if you connect your applications to a centralized user management system, you can impose order on your data.

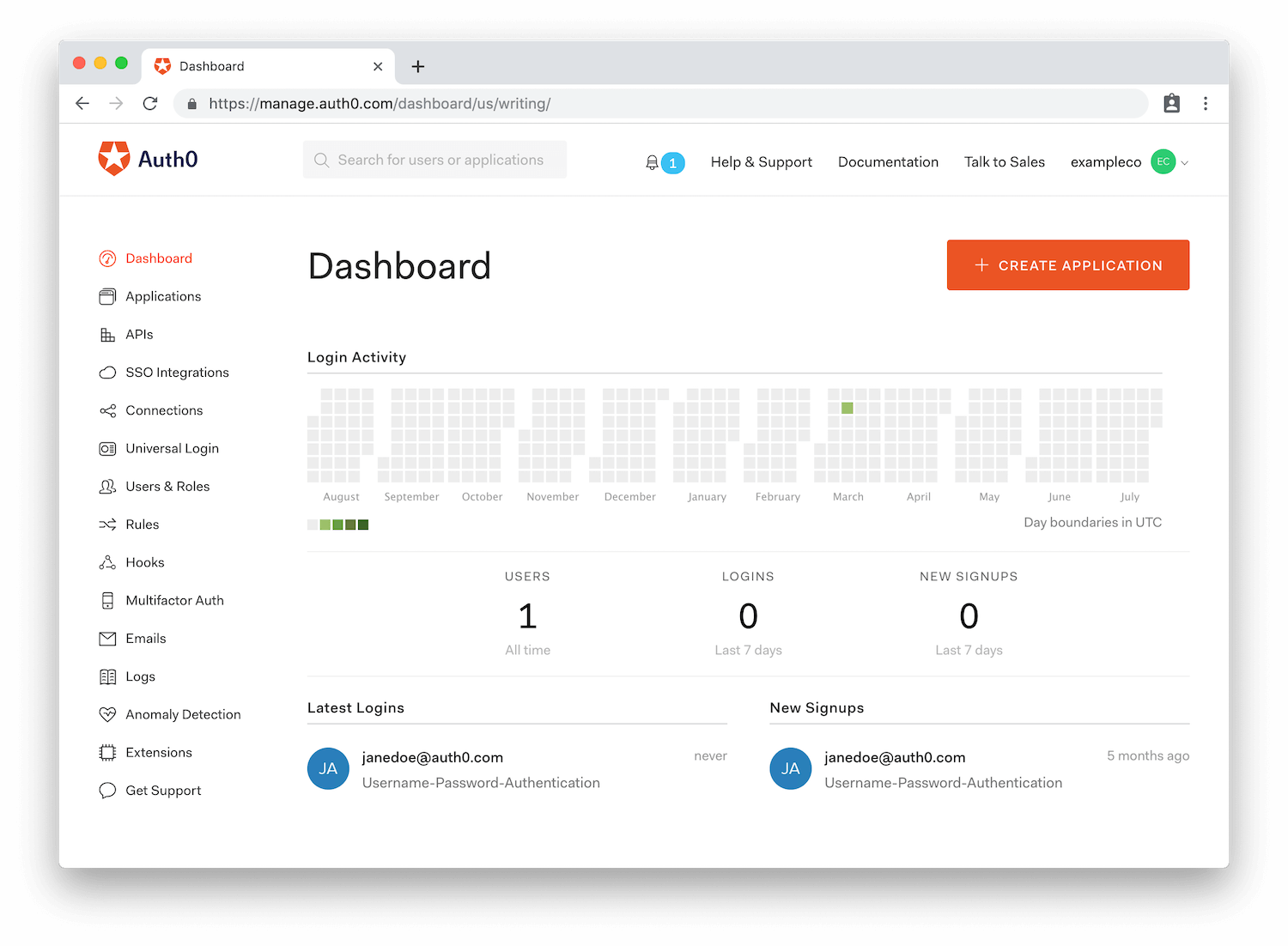

With a dashboard for user management, you can see how your data is being used, manage permissions, and implement heightened security as needed. For example, if there were a spreadsheet of unencrypted customer data, you could see who had access via your dashboard. From there, you could decide that it would be an appropriate place to implement multifactor authentication (MFA), so your employees would have to prove their identities before accessing it.

The simplest solution for proving your data security bona fides is to outsource IAM to a trusted, credentialed IAM platforms like Auth0, whose core competency is data security and compliance. Not only will the right IAM partner provide the appropriate security updates, but it will also lend you its credibility, and your prospective partners will feel more comfortable sharing their data with you.

Give Your Company M&A Appeal

2018 and 2019 were banner years for M&A activity, and the trend will likely continue in 2020. Executives who want to capitalize on this moment have to be able to prove that their partners will be getting data that is streamlined, accessible, and secure, not a tangled legacy application stamped with the idiosyncrasies of in-house developers. With an extensible IAM platform like Auth0, you can position your company for successful deals—not just in getting them signed but in getting them to deliver real shareholder value as well.

About Auth0

Auth0 by Okta takes a modern approach to customer identity and enables organizations to provide secure access to any application, for any user. Auth0 is a highly customizable platform that is as simple as development teams want, and as flexible as they need. Safeguarding billions of login transactions each month, Auth0 delivers convenience, privacy, and security so customers can focus on innovation. For more information, visit https://auth0.com.

About the author

Jenny O'Brien

Business Content Manager